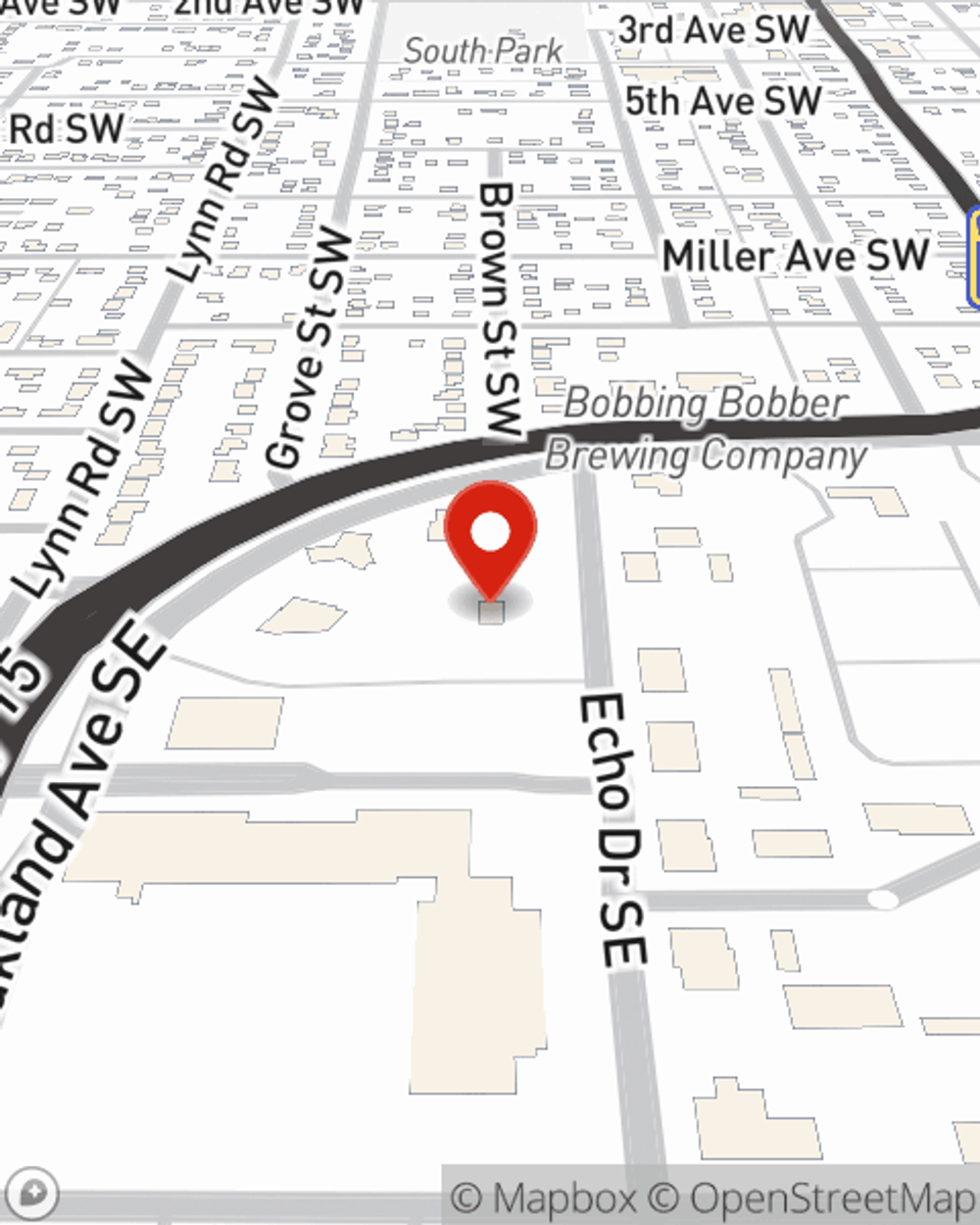

Renters Insurance in and around Hutchinson

Get renters insurance in Hutchinson

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Hutchinson

- Darwin

- Stewart

- Buffalo Lake

- Biscay

- Litchfield

- Glencoe

- Silver Lake

- Lester Prairie

- Winsted

- Cosmos

- Dassel

- Cokato

- Eden Valley

- Winthrop

Insure What You Own While You Lease A Home

Your things are important; keeping them secure should be just as important. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your jewelry to your hiking shoes. Unsure how to choose a level of coverage? No problem! Kim Kotzer is here to help you identify coverage needs and help secure your belongings today.

Get renters insurance in Hutchinson

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps shield your personal possessions in case of the unexpected.

There's no better time than the present! Reach out to Kim Kotzer's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Kim at (320) 587-3909 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.